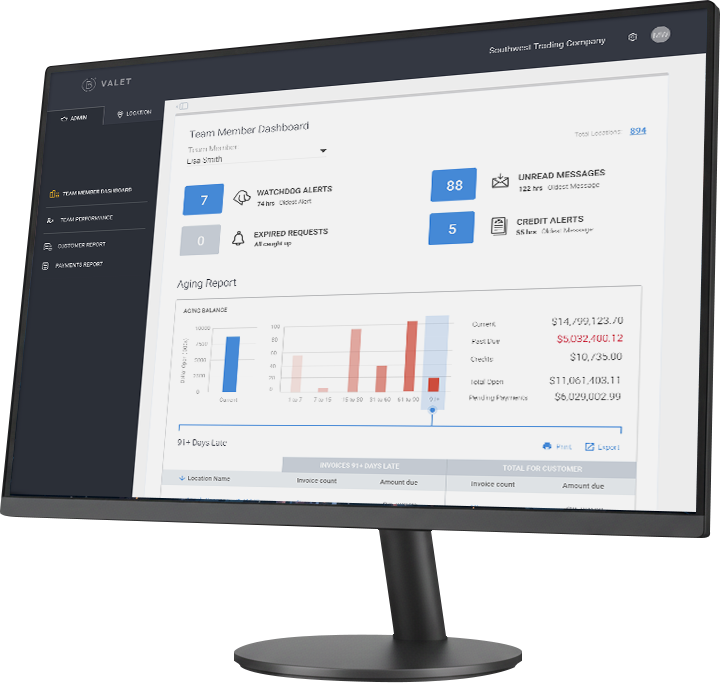

The Complete AR Workflow Built to Accelerate Cash

Billfire unifies electronic invoicing, digital payments, AI-powered collections, and cash application into one streamlined workflow so credit teams work smarter and CFOs see measurable cash impact.

Reduce DSO with structured,

AI-assisted collections

Increase digital payment adoption and speed up cash

Eliminate manual handoffs between collections and cash application

Keep every account aligned with Share My Story

Finally, a System Built for the Way Credit Actually Works

You manage risk, relationships, and cash flow simultaneously. Billfire supports the full AR lifecycle in one environment so you are not jumping between disconnected tools.

• Deliver invoices electronically and remove delivery delays

• Offer frictionless click-to-pay options to improve on-time payments

• Use AI-powered prioritization to focus collectors on the right accounts

• Streamline cash application as payments arrive

• Share full account context with internal stakeholders instantly

With Billfire you can:

Turn AR Into a Cash Acceleration Engine

CFOs do not need another point solution. They need predictable cash, reduced operational cost, and accountability across the AR process.

Billfire improves financial performance by:

• Accelerating invoice-to-cash cycle time

• Increasing digital payment capture

• Reducing manual reconciliation work

• Creating visibility across the full AR workflow

• Aligning teams with a shared view of account status

Everyone Sees the Same Story

“Share the Story” captures the full context of an account including notes, conversation summaries, and recorded interactions so no one has to re-explain what is happening.

Credit, sales, customer service, leadership, and finance stay aligned without extra meetings or internal emails. That alignment alone saves hours every week and reduces miscommunication with customers.

Prove the Value Before You Commit

Because Billfire is fast to deploy, you can evaluate real workflow impact without a long implementation cycle.

What the trial includes:

• Workflow mapping session aligned to your AR process

• Live environment walk-through

• Real data or pilot accounts

• Clear success metrics defined upfront

Low lift. No heavy IT burden. Designed for fast evaluation.